VIPE ANALYTICS SUPPORT

BETTER STOCK PICKING

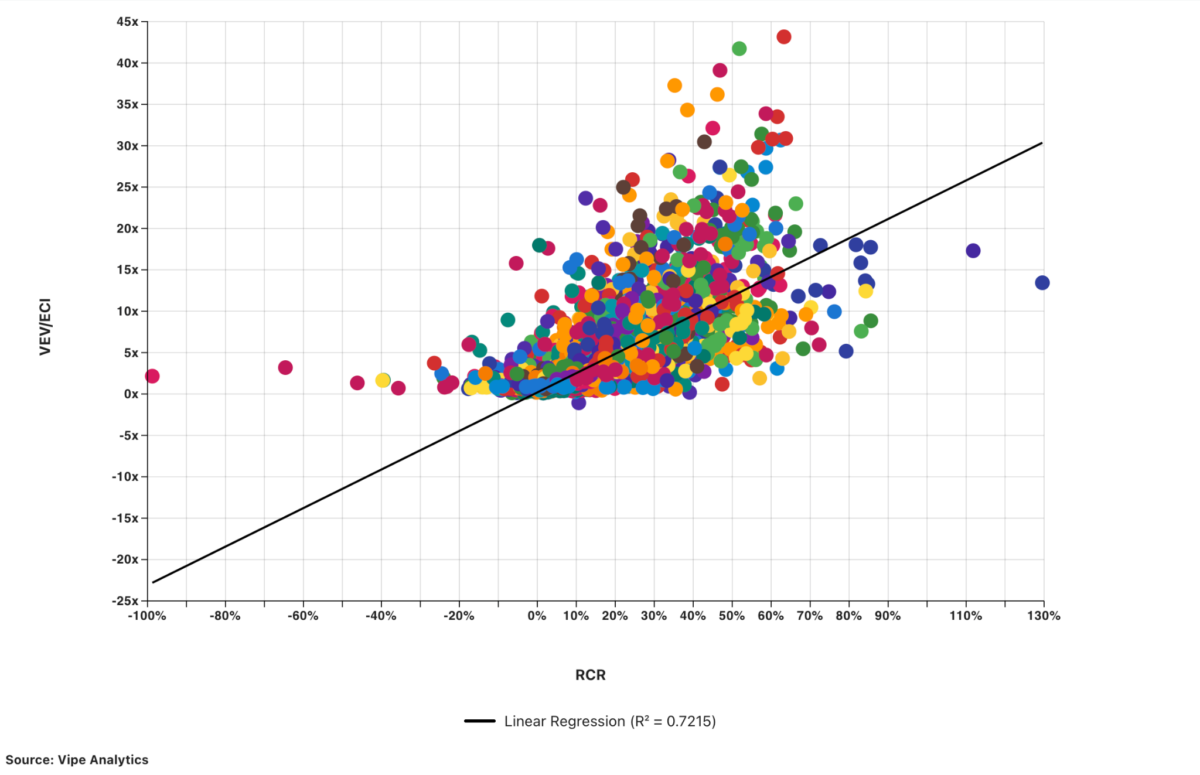

72% R-squared: VIPE correlation between valuation and returns is strong

VIPE FOR EQUITY INVESTORS

VIPE benefits institutions or individuals that analyse equities and make investment decisions.

VIPE SUPPORTS

EQUITY FUND MANAGERS

Fund managers serve mutual funds, pension funds, endowment funds and private client funds and are expected to outperform passive benchmarks:

- VIPE evaluates profitability across multiple countries, sectors and accounting norms

- VIPE corrects what is wrong, normalises what is distorted and adds what is missing

- VIPE data and analytics drive better stock picking and fund performance

VIPE SUPPORTS

QUANTATIVE EQUITY

Global quant funds, especially factor based models, are likely to benefit from VIPE metrics:

- VIPE instantly creates rankings for systematic stock selection

- Set Price/Earning and Real Cash Return criteria to fine tune models

- Identify high quality companies at resonable prices

VIPE SUPPORTS

ETF PLATFORMS

Smart ETFs are particularly well placed to benefit from VIPE’s metrics.

- VIPE data and analytics are specifically engineered for systematic equity investing and indices

- Smart Beta ETFs are set to perform better when traditional data is replaced with VIPE analytics

VIPE SUPPORTS

RETAIL SECTOR & FINANCIAL ADVISERS

Retail investors and those advising retail clients can incorporate VIPE metrics and analytics into their service offering:

- Retail plaforms can add VIPE metrics to provide additional information to help their clients select investments

- Financial advisers can build VIPE into their portfolio and risk profile strategies for a broad range of clients

- The consistency and normalisation of VIPE data increases confidence in clients’ investment choices

The Core of Smarter Investing

Three pillars that define how Vipe Analytics transforms complex financial data into clarity, confidence, and precision for equity investors.

Precision Beyond Accounting

We go beyond traditional financial metrics, transforming raw accounting data into meaningful economic insights that reveal the real value behind every company.

Clarity Through Innovation

Our proprietary adjustments cut through the noise of inconsistent accounting standards, delivering data that is consistent, and comparable. We values intangibles, the most important corporate assets of this centrury.

Smarter Decisions, Confident Investments

By turning complex financials into clear intelligence, we empower investors to make faster, smarter, and more contextualized investment choices.